If you’re new to entrepreneurship and need help getting started with accounting for your franchise, you’re in the right place. Here, we’re going to cover everything you need to know about franchise accounting, including how to do it yourself and how to know if you need to hire a professional. Cost of goods sold (COGS) is the direct cost of producing the goods sold by the franchise. COGS is an important metric for the franchise owner, as it helps to determine the gross profit margin. Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images. So you can deduct the initial and ongoing franchise fees from your tax return.

What Services Do Bookkeeping Franchises Offer?

BookWerks™ is a cloud-based bookkeeping firm with its roots in Cincinnati, Ohio that provides assistance to businesses in a variety of industries throughout the country. From dental practices to restaurants and emerging franchises, and everyone in between. If you’re a business owner who is still doing your own books, it’s time to STOP Bookkeeping and start BookWerking™. Again, this is part of your franchise agreement and must be followed to the letter to stay on the good side of your brand. Attend to royalties religiously to make sure your numbers are accurate and you don’t get behind. Your franchisor may give you a template or specific instructions for reporting these expenses.

Compliance and Reporting

However, not all brands are as transparent as they could be or have a financial performance representation they feel will be beneficial to show it to prospects. No matter how proficient you are at running your franchise, doing bookkeeping for multiple businesses is tough. Common problems of incomplete and incorrect bookkeeping create both frustration and anxiety between franchisors and their franchise partners. These issues could ultimately lead to an inaccurate picture of how healthy individual franchises actually are.

“Shoeboxed makes it stupid simple to scan receipts…”

It’s a crucial aspect of running a franchise, which helps to monitor revenue, expenses, and cash flow. Proper accounting ensures that the franchise is profitable, and all financial transactions are compliant with tax laws and regulations. Payroll Vault Franchising is another bookkeeping franchise that specializes in payroll services. They offer a wide range of payroll services to businesses of all sizes, including payroll processing, tax compliance, and more.

Maintain Accurate Records

Franchise owners can track financial performance across different locations, helping identify trends and improvement areas. However, some franchise-specific costs need to be considered when handling franchise bookkeeping. Franchising is an excellent option for business owners and entrepreneurs.

- For many franchise owners, bookkeeping is the most complex part of business operations.

- Xero has a robust open API, so it integrates with a wider range of business applications.

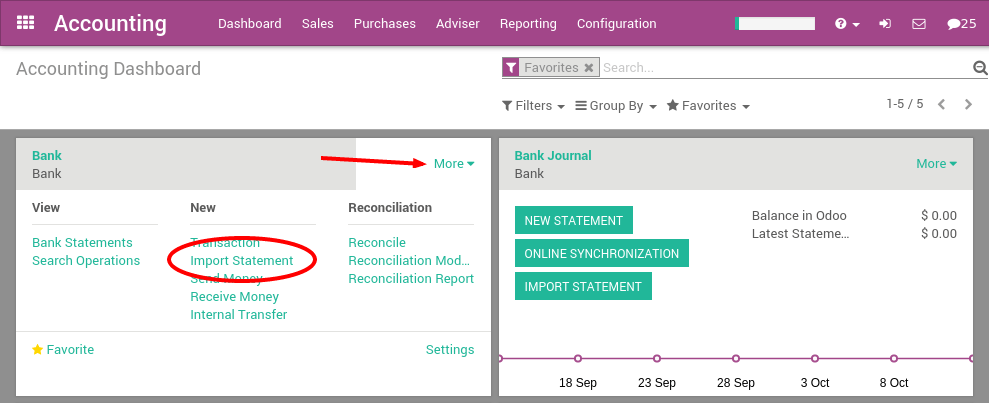

- You can use accounting software to automate bookkeeping and financial management processes.

- This provides franchisors and franchisees with a clear view of the overall system’s performance.

The franchisor and the franchisee have unique bookkeeping needs that need to be met to build a successful business and ensure the franchise thrives. Cloud-based software often comes with pre-configured templates and workflows suited to specific franchise enrolled agent ea definition models. This ensures bookkeeping consistency across all locations and franchisees, simplifying procedures and reducing training time for new franchisees. Accurate records across the board helps with accurate performance benchmarking against other locations.

Using online accounting for small business can help franchise owners and franchisors communicate about the business’s cash basis accounting: explain examples, contrast with accrual finances. They can access the software program from anywhere with an Internet connection so that both parties have instant access financial records. Using a single software provider for accounting and payroll for franchises could also lead to a volume discount for these services.

Customization within Xero offers a high degree of flexibility for franchisees to tailor financial data to franchisors’ specific expectations. Xero also offers built-in inventory management features to make things easier within franchise models with physical product sales. Our services include expense tracking, payroll management, financial reporting, bank reconciliation, tax preparation, and more.

It is typically a percentage of gross sales, but some franchises have minimum royalty payments. This allows franchises to continue operating during slow months and not getting cancelled for poor performance. This is one of those costs that you only need to worry about when doing bookkeeping for franchisees specifically. Understanding these types of fees is vital when considering bookkeeping outsourcing solutions.

For tax purposes, what is the extended accounting equation the cost is amortized over the life of the franchise agreement. These purchases can impact cost structures in a way that does not affect independent business owners. It boils down to the lack of flexibility that franchisees enjoy in terms of sourcing.